Dec 04, · When trading Forex, you can have as many as 7 or 8 orders to deal with when constructing a single trade. Forex Binary Options. Binary options have a unique payout structure, and this allows traders to achieve a risk to reward ratio that is much more favorable and put in place automatically when positions are opened. Dec 21, · Binary options and day trading are both ways to make (or lose) money in the financial markets, but they are different animals.A binary option is a type of options . Nov 03, · The binary trading offers 5 variants of the trading types. These options are high or low, 60 seconds, one touch, boundary, and option builder. Whereas, the forex trading offers several option types for the trading including buy or sell, limit, stop, One Cancels the /5().

Binary Options vs. Forex Trading: Understanding the Difference | Finance Magnates

Binary options and day trading are both ways to make or lose money in the financial marketsbut they are different animals. Day trading, forex trading vs binary option trading, on the other hand, forex trading vs binary option trading, is a style of trading in which positions are opened and closed during the same trading session. A day trader's profit or loss depends on a number of factors, including entry price, exit price, and the number of shares, contracts or lots that the trader bought and sold.

An option is a financial derivative that gives the holder the right, but not the obligation, to either buy or sell a fixed amount of a security or other financial asset at an agreed-upon price the strike price on or before a specified date. A binary option, however, automatically exercises, so the holder does not have the choice to buy or sell the underlying asset. Binary options are available on a variety of underlying assets, including stocks, forex trading vs binary option trading, commodities, currencies, indices and even events, such as an upcoming Fed Funds Rate, Jobless Claims and Nonfarm Payrolls announcements.

If you think yes, you buy the binary option; if you think no; you sell. The price at which you buy or sell the binary option is not the actual price of gold in this example but a value between zero and The trading range fluctuates throughout the day, but always settles at either if the answer is yesor zero if the answer is no. Binary options traders "gamble" on whether or not an asset's price will be above or below a certain amount at a specified time.

Day traders also attempt to predict price direction, but profits and losses depend on factors like entry price, exit price, size of the trade, and money management techniques. Like binary options traders, day traders can go into a trade knowing the maximum gain or loss by using profit targets and stop losses. Day traders, however, can "let their profits run" to take full advantage of large price moves. Of course, day traders could also let their losses get out of control by not using stop losses or by holding onto a trade in the hopes that it will change direction.

Day traders buy forex trading vs binary option trading sell a variety of instruments including stocks, currencies, futurescommodities, indices and ETFs. Investing Essentials. Advanced Technical Analysis Concepts. Your Forex trading vs binary option trading. Personal Finance.

Your Practice. Popular Courses. Take the Next Step to Invest. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Related Terms Binary Option A binary option is a financial product where the parties involved in the transaction are assigned one of two outcomes based on whether the option expires in the money.

Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Expiration Date Derivatives Definition The expiration date of a derivative is the last day that an options or futures contract is valid.

Double No-Touch Option Definition A double no-touch option gives the holder a specified payout if the price of the underlying asset remains in a specified range until expiration.

How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price.

The strategy limits the losses of owning a stock, but also caps the gains. Investopedia is part of the Dotdash publishing family.

QUIT BINARY OPTIONS AND START FOREX? - WHICH ONE SHOULD I CHOOSE?

, time: 15:24Binary Options vs Forex – Which is best? () - Quora

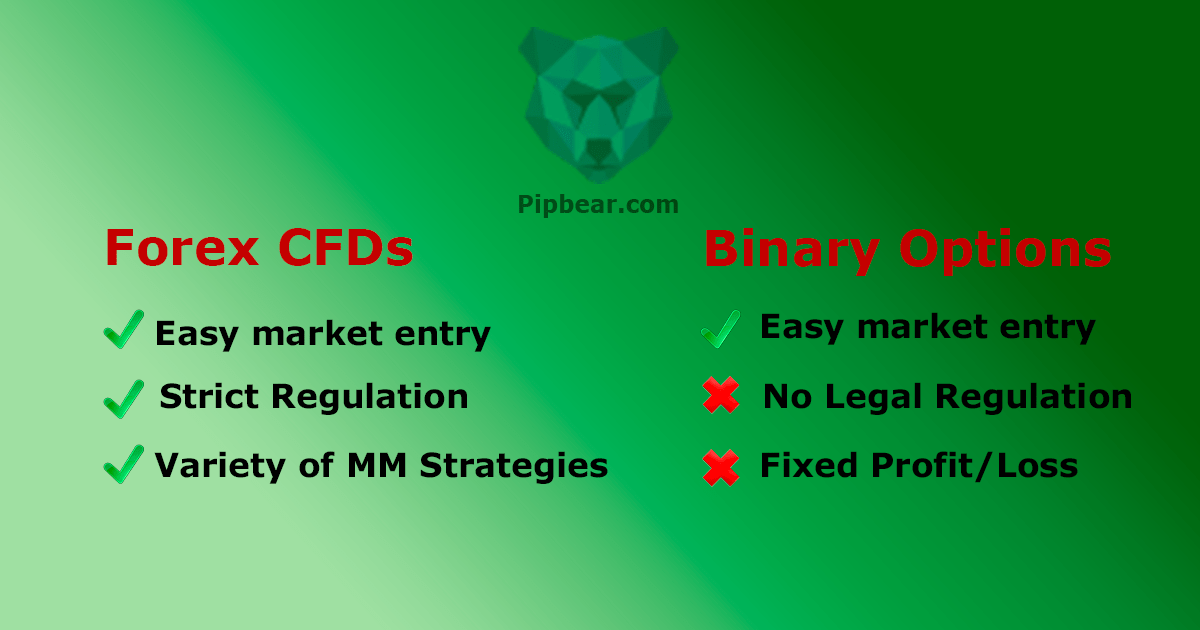

Dec 21, · Binary options and day trading are both ways to make (or lose) money in the financial markets, but they are different animals.A binary option is a type of options . 9 rows · Pros & Cons Of Forex Trading Vs Binary Options Access. Forex trading – The currency. If you have been learning about binary options trading, doubtless by now you have also started picking up some tips and tricks for trading Forex. The two are very closely related, mostly because you can trade currencies either way. Binary options is simply a different way to trade—and you can also trade .

No comments:

Post a Comment