Japanese Yen USD JPY currency usd jpy forecast japanese yen forecast forex yen rates yen tick charts Yen quotes yen charts yen cross quotes yen forecast yen brokers yen forex news yen commentary research yen foreign exchange forex Exchange rates fluctuate continuously due to the ever changing market forces of supply and demand. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen. The Forex market remains open around the world for 24 hours a day with the exception of weekends 04/05/ · Speaking of yen, we compare it with US dollar. At Forex, relation between dollar and yen is represented in a pair of dollar / yen (USD/JPY). Yen has its own Central bank which uses interventions and a key interest rate to control the currency. To make efficient forecasts of USD/JPY exchange rate, information from the Bank of Japan is not enough

JPY (Japanese Yen) - Latest News, Analysis and Forex Trading Forecast

To earn on foreign exchange market, you need to compete with professional players, forex market yen exchange rate, such as banks, investment funds and companies. Article content. Here is your manual for yen trading for After the Second World War, Japanese economy was devastated. Due to the weak economy, yen depreciated and was undervalued. Such a decision was a part of the Bretton Woods Agreement on peace established after the World War II by the USA for the countries that had suffered from the war, forex market yen exchange rate.

Currently, 1 USD costs Yens. Since the war, value of Japanese currency has become three times larger:. The key market player that has been historically affecting the yen exchange rate is the Bank of Japan, which will be our further subject matter of the story.

When the USA had refused from using the Bretton Woods system inthe exchange rate of yen went up and continued increasing every year. Japanese government was concerned by yen getting stronger: the country wanted to improve its economy due to export activities, to which high value of yen was an obstacle. For export to be profitable, foreign investors needed cheap yen for them to buy Japanese goods at favorable prices.

For this reason, the Bank of Japan decided to weaken the national currency, forex market yen exchange rate. Inthe Bank of Japan pursued a number of financial interventions by buying and selling dollars and yens to knock down the exchange rate of the Japanese currency. The currency market had become open by then, so anybody was able to buy forex market yen exchange rate sell USD and yen. In addition to Bank of Japan, other players also participated in the speculations:.

Management of the Bank of Japan realized that interventions only bring some short-term effect. A zero-interest rate means that when you get credit funds in yen, you are asked nothing in return.

Speaking of yen, we compare it with US dollar. Yen has its own Central bank which uses interventions and a key interest rate to control the currency. The Race of the Two Banks All Central banks manage their currencies in a similar way:. For fundamental analysis of yen, follow the news and reports on monetary policy of Central banks of both Japan and the USA.

Check out the main events in the economic calendar. Governments pursue different monetary policy to manage money flow. But there is also another side of the policy, which is relations between the countries. President and Parliament are the key political figures. It is them who manage social situation in a country, forex market yen exchange rate.

Heads of state are key figures of the economies. Traders keep an eye on their verbal interventions — wordsto foresee which way the currency rate will go. In addition to press conferences and meetings, Twitter is another source where one can find ideas expressed by heads of states:. Usually, heads of countries only make hints about the future in the country, but sometimes they actually speak out what they think.

To figure out how to analyze presidential twits and verbal interventions, get an insight into articles about similar situations in the past. Relation forex market yen exchange rate currencies in the past and in the present is studied by technical analysiswhich is an art of reading charts. Have a look at the scale to the right of the chart: the fewer yens are paid for the dollar, the stronger the Japanese currency is.

In the example above, yen grew from up to Technical analysis trains a trader to look for key spots at the chart using patterns which are templates repeated for centuries. Patterns are repeated because people are predictable in their money-related decisions. Whenever a trader speculates, he or she gets excited, angry and happy just as their ancestors did years ago.

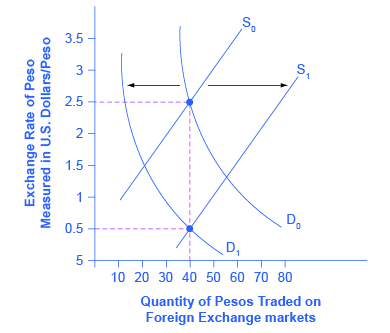

All the market players have regard for those areas. They can be better distinguished at a daily timeframe:. The supply area is above, the demand area is below. It is demand and supply that are managing the dollar to yen exchange rate. Demand and supply are the main driver of any share, any currency and any asset. The demand and supply areas can be found at any chart. Demand for JPY is willingness of the market players to sell a dollar in order to buy a yen.

Supply for JPY is when you sell yen to buy dollars for further purchasing goods and services from the USA. Forex market yen exchange rate the chart above, the demand areas can be seen below the chart and indicate the exchange rate where traders buy dollars and sell yen. The supply areas can be seen above the chart and indicate the exchange rate where traders sell dollars and buy yen.

To locate the demand-and-supply area, find the segment in the chart where the trend was seen to reverse 2 or more times. More often and stronger price reversals at the area indicate a stronger price.

Traders are waiting for reversal at the demand-and-supply areas and confirm reversal by technical patterns:. If you want the candlestick setup more likely to work out, trend trading at the demand and supply area is recommended. For the most efficient forecast, traders use both technical and fundamental analyses in conjunction.

We made a list of resources where you can feed yourself with new investment ideas. Once a weak, check out the links for new information. Morgan Stanley, a multinational investment bank, makes regular publications on macroeconomics. Subscribe for the mail-out and listen to audio podcasts. BlackRock bank offers fresh insight on the currency market. Once a week they publish new articles and audios at the website. Yen will drop, while dollar will grow:. The recommendations below will be valid for more than one forex market yen exchange rate. Now you know how Central banks control money flow using key interest rate, and which macroeconomic information to consider when making analysis.

To make a forecast, learn the history of USDJPY price with basics of technical analysis :. Use the candlestick analysis to enter the market. Did you know that candles have been invented in Japanthe native land of yen? You are free to use it to analyze other currency pairs in future. By continuing to browse this website, you forex market yen exchange rate to our Cookie policy. Free trading app for Android. Home Blog Economy How forex market yen exchange rate Trade on Yen in A Forex Trader Complete Guidance.

Article content 1 History of Yen 2 The Forex market yen exchange rate of Japan 3 Revanche of the BoJ: Key Interest Rate 4 Economy of the USA 4. Revanche of the BoJ: Key Interest Rate. Heads of State of the USA and Japan. The Right Spot in the Chart. The Most Popular Pattern.

How to Figure Out Demand and Supply. How to Locate Areas of Demand and Supply at a Chart. How to Find Reversal in the Chart. Ideas from Morgan Stanley.

CitiGroup Analytics. Insights from BlackRock. Forecast for USDJPY, forex market yen exchange rate. AMarkets App Free trading app for Android Free trading app for iOS.

Foreign Exchange Rates - Cross Rates

, time: 5:50Indicative Exchange Rates of Local Banks and FOREX Dealers | Bank of Mauritius

Japanese Yen USD JPY currency usd jpy forecast japanese yen forecast forex yen rates yen tick charts Yen quotes yen charts yen cross quotes yen forecast yen brokers yen forex news yen commentary research yen foreign exchange forex Exchange rates fluctuate continuously due to the ever changing market forces of supply and demand. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen. The Forex market remains open around the world for 24 hours a day with the exception of weekends 09/09/ · JPY (Japanese Yen) - Latest News, Analysis and Forex Trading Forecast. Real Time News. RT @BrendanFaganFx: 80 counterparties take $ trillion at Fed's fixed-rate reverse repo $USD $DXY. https

No comments:

Post a Comment