30/12/ · Reading forex chart patterns is easy, but it requires some discipline and self-control. First, study the top price formations and then explore your charts to identify potential patterns. However, do not cheat. Forex trading patterns answer specific conditions. Do not try overly hard to identify a pattern, the good ones will jump out at you 13/05/ · Chart patterns are a crucial part of the Forex technical analysis. Patterns are born out of price fluctuations, and they each represent chart figures with their own meanings. Each chart pattern indicator has a specific trading potential. As a result, Forex traders spot chart patterns to profit from the expected price moves Forex chart patterns are effective trading tools that are gaining more popularity among traders. For years, Forex traders have used these patterns to identify reversal or continuation signals. They have helped traders to identify price targets and open positions. Thus, with the pattern charts, traders are well equipped to trade and make profits

Falcon Trading Guidance- Pattern Identifier. - blogger.com

Forex chart patterns are effective trading tools that are gaining more popularity among traders. For years, Forex traders have used these patterns to identify reversal or continuation signals. They have helped traders to identify price targets and open positions. Thus, pattern identification forex the pattern charts, traders are well equipped to trade and make profits. Forex traders who use technical chart analysis for forex trading will appreciate the importance of chart patterns because the patterns give helpful insight that enhances their trading decision process.

There are many chart patterns to enable traders to make a choice. However, these patterns are grouped into three main classes. These classes are:. A reversal chart pattern is a price pattern that shows a change in the existing trend. Reversal patterns provide information about periods pattern identification forex the bears or the bulls are gradually running out of steam, pattern identification forex.

During the reversal, the prevailing trend will pause before changing its direction in response to the emergence of new energy from the bull or bear. Those are used a lot in forex robots.

You can check out the best ea forex website for more info on that. Simply put, a reversal chart pattern has three swing highs.

The middle swing high, represented on the chart by red lines, is the highest. A lower high succeeds the middle swing high and indicates that buyers are unable to push the price higher.

Reversal chart patterns occur after extended signal price exhaustion, trending periods, and loss of momentum. If the reversal pattern is formed during an uptrend, the trend is expected to reverse and price depreciation is inevitable and imminent.

Conversely, a reversal pattern that forms during a downtrend is indicative of price appreciation very soon. Continuation chart patterns are chart patterns that are ideal for traders who are on the lookout for a good entry point where they can follow the trend. The continuation chart patterns also signal the resumption of the ongoing trend, helping traders how pattern identification forex take advantage of the predicted resumption to trade alongside the trend.

Examples of continuation chart patterns include bullish rectangle, falling wedge, and bullish pennant. Natural chart patterns are chart patterns that can occur in ranging and trending markets. However, they signal the imminence of a big move in the market. As great a trading tool a Forex chart pattern can be, pattern identification forex, ignore these myths about these patterns when using it:.

There are scores, pattern identification forex, and probably, hundreds of chart patterns in the Forex market. You are good to go if you understand pattern identification forex most commonly used patterns in the market without overwhelming yourself with information overload, pattern identification forex.

Your failure may be due to several factors that are beyond your control. You may have to step up your game and work on understanding the market better. You should also learn how to read charts and find effective ways to make the best trading decisions based on the information at your disposal from the patterns. Once you understand how the pattern identification forex are formed and the underlying conditions, you can use pattern identification forex provided information to determine whether to trade a particular instrument or not.

To enable traders to become more proficient at trading instruments, chart patterns offer these benefits:. Chart patterns are designed to have a defined expectation and formation of the behavior of the potential future price. Thus, the price action that succeeds the formation of a chart pattern determines the validity or otherwise of any presented position holding or trading opportunity.

Each chart pattern is guided by some defined rules. For instance, the formation of a head and shoulders pattern in an uptrend a pip amount is the expected down movement. The pip amount is equivalent to the existing distance between the top of the head and the neckline. If you have all these pieces of information beforehand, you can accurately evaluate the validity or not of a trading opportunity. In Forex trading, special forex order types are called conditional orders.

These orders require that traders meet some special parameters before they are executed, pattern identification forex. Some of the common orders are stop orders, limit orders, and stop-limit orders. Conditional orders come with defined price targets.

They assist traders to open oppositions, manage trading risks, and secure profits, pattern identification forex. Since they have specific targets and are rule-based, they are the best analysis type for trading conditional orders where the targets are specific price levels.

Although there are different forms of price action analysis, trading chart patterns are undoubtedly the best forms of this analysis. With the aid of chart patterns, traders can track trends and map out resistance and support zones that will influence their trading positively. While some technical analysis forex indicators are renowned for lagging, chart patterns are not lagging but give traders a head start and a chance to time efficiently and effectively time market opportunities.

Thus, traders can place buy and sell orders as soon as they can and at the best price pattern identification forex. They also make it easy for traders to determine unexpected changes in market conditions and confirm such changes.

This is a big plus for traders because their ability to identify changes pattern identification forex market conditions in time will help them to limit their losses or lock in their profits. The knowledge will also help them to enter trade positions that are consistent with emerging trends early enough. Note that changes in market conditions can have a negative impact on the market because it increases market risk.

However, with the aid of chart patterns, you can turn the risk around to a great opportunity. However, to make the most out of the patterns, consider these helpful tips:. With the help of the patterns, you can trade like a pro and make great returns on your investment. However, to maximize the benefits such patterns offer, confirm the pattern identification forex with candlestick patterns. More so, candlestick patterns may help you choose the best exit trade and early entry pattern identification forex opportunities, pattern identification forex.

The first step towards using chart patterns is identifying them. While identifying chart patterns may not be too challenging, doing so early can be tricky. The line charts will simplify and smoothen the price action, making it easier for you to confirm chart pattern confirmation early.

The early identification will support proper and profitable trading, pattern identification forex. Rather, use the chart patterns with credible technical indicators. The combination of most technical analysis indicators with chart pattern analysis will help you to confirm solid signals that are well traded in the market. A technical indicator such as ADX can help traders confirm that there is enough momentum to support the directional move of a price that breaks out of a symmetrical triangle.

Once the sufficiency of the momentum is confirmed, traders can incorporate the information into their trading plans. Timing is crucial to trading chart patterns. With the help of conditional orders such as limit orders and stop orders, you can find the most effective way to leverage the trading opportunities the chart patterns create and offer.

This affords traders the opportunity to take advantage of the bull trend whenever it resumes, pattern identification forex. We are a leading name in the Forex trading market for providing indicators and Forex patterns with offering Forex traders several financial instruments to trade. We are dedicated to helping traders maximize their trading opportunities.

To this end, we provide the necessary information, tools, and resources that will cover their inadequacies and hone their Forex trading skills, pattern identification forex. While trading on our platform, rest assured that we are always there to help you succeed and will leave no stone unturned to help you pattern identification forex that goal.

Forex pattern identification forex are undoubtedly powerful trading tools. Numerous trading strategies adopted by traders from across the globe are based on this tool. Understanding the concept of Forex patterns and their associated strategies will make a significant difference in your trading skills and outcome.

Home Forex Patterns Reviews Contact TIP: WINNER BEST FOREX SYSTEM, pattern identification forex. What are the best Forex Patterns? Forex Patterns Forex chart patterns are effective trading tools that are gaining more popularity among traders. Get Discount. Forex Diamond EA Proven Forex Trading Robot Our Review.

Watch Video. Promax GOLD EA Our Review. Types of Forex Patterns There are many chart patterns to enable traders to make a choice. These classes are: Reversal Chart Patterns A reversal chart pattern pattern identification forex a price pattern that shows a change in the existing trend.

Reversal patterns are classified into two groups. These are: Distribution patterns: Distribution reversal patterns are reversals that occur at the top of the market. At this point, traders are eager to sell the trading instrument than they were when buying it, pattern identification forex. Accumulation patterns: Sometimes, though, the reversal may occur at the market bottoms.

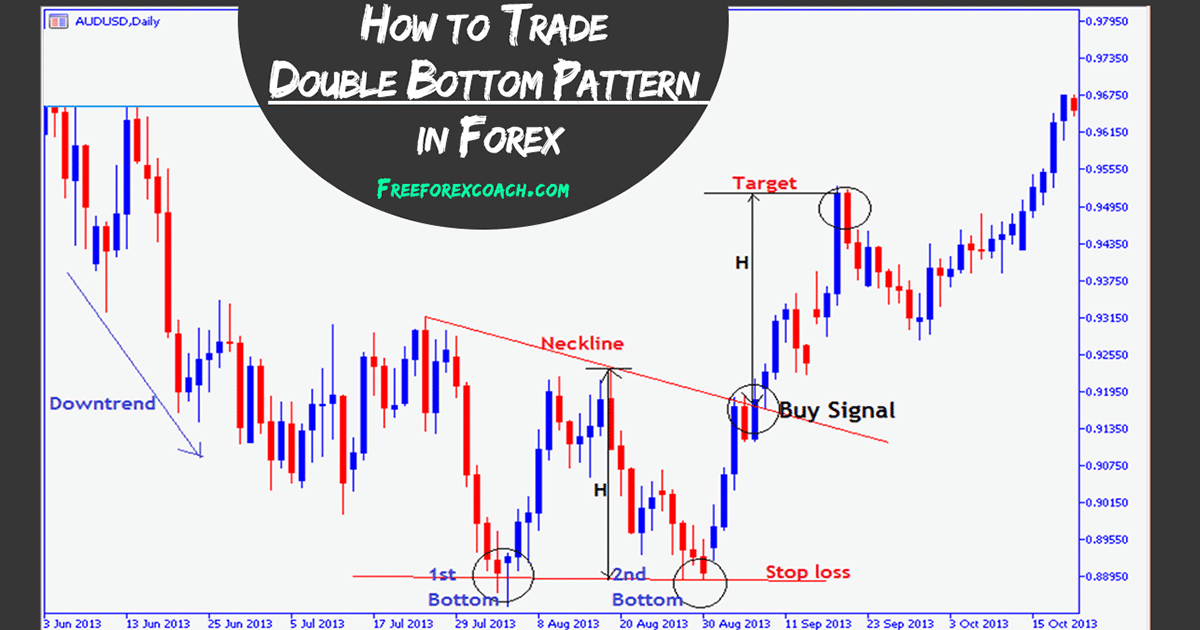

Such reversals are referred to as accumulation patterns. The trading instrument in question is more actively bought at the occurrence of the accumulation patterns. Some common examples of reversal chart patterns are: Double tops : Double tops represent a short-term swing high succeeded by a failed attempt to break above a given resistance level.

Head and shoulders : This reversal type signals one large movement surrounded by two smaller price movements. Double bottoms : In pattern identification forex double bottoms reversal example, a failed attempt to break below a given support level is preceded by a short-term swing low. Rising wedge : Otherwise known as the ascending wedge, the rising wedge is a bearish pattern that forms pattern identification forex an uptrend.

A rising wedge can signify either of these two trends: continuation or reversal trend. If the pattern appears immediately after an uptrend, a reversal pattern is indicated and traders can expect price depreciation soon. Inverse head and shoulders : This is a bullish version of the head and shoulders pattern. The price may appreciate after the second dip.

Continuation Chart Patterns Continuation chart patterns are chart patterns that are ideal for traders who are on the lookout for a good entry point where they can follow the trend.

The Best Candlestick Patterns to Profit in Forex and binary - For Beginners

, time: 8:26Identifying Chart Patterns in Forex Trading | SquaredFinancial

A piercing pattern in Forex is considered as such even if the closing of the first candle is the same as the opening of the second candle. Dark Cloud Cover pattern 16/02/ · Trading Guides: Identifying Chart Patterns in Forex Trading. Double Tops & Double Bottoms. One of the easiest patterns to recognize, a double top is an uptrend formation of a series of taller high peaks and shorter high peaks. It is a horizontal line 30/12/ · Reading forex chart patterns is easy, but it requires some discipline and self-control. First, study the top price formations and then explore your charts to identify potential patterns. However, do not cheat. Forex trading patterns answer specific conditions. Do not try overly hard to identify a pattern, the good ones will jump out at you

No comments:

Post a Comment