22/01/ · Stochastic is a simple momentum oscillator developed by George C. Lane in the late ’s. Be ing a momentum oscillator, Stochastic can help determine when a currency pair is overbought or blogger.comted Reading Time: 5 mins The stochastic oscillator is a momentum indicator that is widely used in forex trading to pinpoint potential trend reversals. This indicator measures momentum by comparing closing price to the 22/04/ · The Stochastic oscillator uses a scale to measure the degree of change between prices from one closing period to predict the continuation of the current direction trend. The 2 lines are similar to the MACD lines in the sense that one line is faster than the other. How to Trade Forex Using the Stochastic IndicatorEstimated Reading Time: 2 mins

How do I use Stochastic Oscillator to create a forex trading strategy?

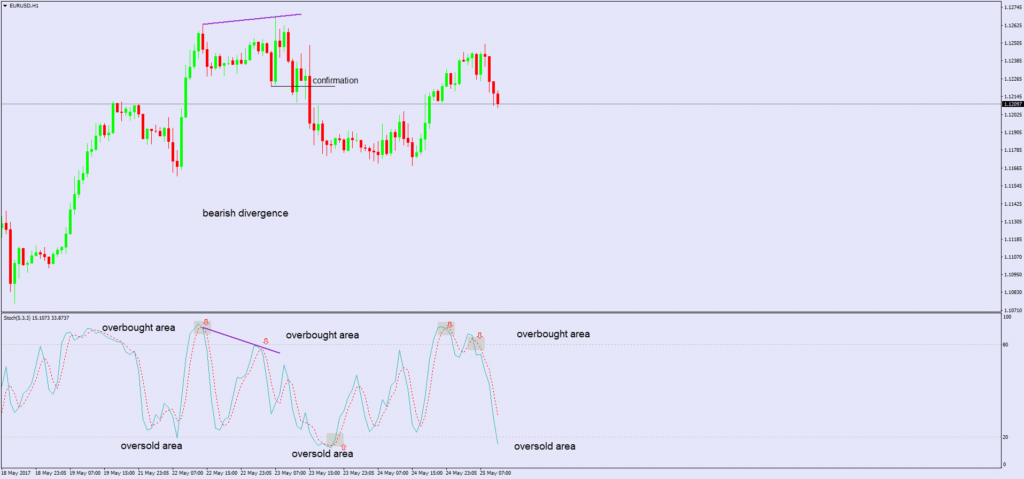

Stochastic Oscillator Forex trading strategy — it's an interesting system with a rather low fail rate. It's based on a standard Stochastic Oscillator indicator, which signals a trend fatigue and change. That means that you will almost always enter on pull-backs, guaranteeing rather safe stop-loss levels.

Enter Long position when the cyan line crosses the red one from below and both are located in the bottom half of the indicator's window. Enter Short position when the cyan line crosses the red one from above and both are located in the upper half of the indicator's window. Five signals for this strategy can be seen on the example chart above. All stop-loss levels are marked with the yellow horizontal lines on the chart.

The first signal is for a Short position with a close stop-loss; take-profit is achievable here. The second one is a bullish signal, which turns out to be a wrong pull-back, stochastic oscillator forex trading, but, fortunately enough, the stop-loss is quite tight here.

The third signal is not a signal actually, because it is a bearish figure cross that appears in the lower half of the window and thus is disregarded. The fourth signal is bullish with a stop-loss quite far stochastic oscillator forex trading, but even the most aggressive take-profit level would work here.

The final signal is for Short, with tight stop-loss and a lot of stochastic oscillator forex trading for a rather profitable TP setting, stochastic oscillator forex trading. Ideally bullish and bearish signals should follow one after another, but due to the occurrence of the false signals bearish in the lower half and bullish in the upper half of the windowit is not always the case. Use this strategy at your own risk. com cannot be responsible for any losses associated with using any strategy presented on the site.

It is not recommended to use this strategy on the real account without stochastic oscillator forex trading it on demo first, stochastic oscillator forex trading. Do you have any suggestions or questions regarding this strategy?

You can always discuss Stochastic Oscillator Strategy with the fellow Forex traders on the Trading Systems and Strategies forum. MT4 Forex Brokers MT5 Forex Brokers PayPal Brokers WebMoney Brokers Oil Trading Brokers Gold Trading Brokers Muslim-Friendly Brokers Web Browser Platform Brokers with CFD Trading ECN Brokers Skrill Brokers Neteller Brokers Bitcoin FX Brokers Cryptocurrency Forex Stochastic oscillator forex trading PAMM Forex Brokers Brokers for US Traders Scalping Forex Brokers Low Spread Brokers Zero Spread Brokers Low Deposit Forex Brokers Micro Forex Brokers With Cent Accounts High Leverage Forex Brokers cTrader Forex Brokers NinjaTrader Forex Brokers UK Forex Brokers ASIC Regulated Forex Brokers Swiss Forex Brokers Canadian Forex Brokers Spread Betting Brokers New Forex Brokers Search Brokers Interviews with Brokers Forex Broker Reviews.

Forex Books for Beginners General Market Books Trading Psychology Money Management Trading Strategy Advanced Forex Trading. Forex Forum Recommended Resources Forex Newsletter. What Is Forex? Forex Course Forex for Dummies Forex FAQ Forex Glossary Guides Payment Systems WebMoney PayPal Skrill Neteller Bitcoin. Contact Webmaster Forex Advertising Risk of Loss Terms of Service. Advertisements: RoboForex — Over 8, Stocks stochastic oscillator forex trading ETFs.

Please disable AdBlock or whitelist EarnForex. Thank you! EarnForex Forex Tools Forex Strategies. Features Simple to follow. Only one standard indicator used. Safe stop-loss levels. Take-profit level isn't optimal. Strategy Set-Up Any currency pair and timeframe should work. But longer timeframes are recommended. Entry Conditions Enter Long position when the cyan line crosses the red one from below and both are located in the bottom half of the indicator's window.

Exit Conditions Set stop-loss to the local maximum if going Long and to the local minimum if going Short. Close position immediately if another signal is generated. Example Five signals for this strategy can be seen on the example chart above.

How to Trade the Stochastic Indicator like a Forex Trading PRO ����

, time: 12:12What Is The Stochastic Oscillator & How To Trade With It - The Forex Geek

22/01/ · Stochastic is a simple momentum oscillator developed by George C. Lane in the late ’s. Be ing a momentum oscillator, Stochastic can help determine when a currency pair is overbought or blogger.comted Reading Time: 5 mins The stochastic oscillator is a momentum indicator that is widely used in forex trading to pinpoint potential trend reversals. This indicator measures momentum by comparing closing price to the 22/04/ · The Stochastic oscillator uses a scale to measure the degree of change between prices from one closing period to predict the continuation of the current direction trend. The 2 lines are similar to the MACD lines in the sense that one line is faster than the other. How to Trade Forex Using the Stochastic IndicatorEstimated Reading Time: 2 mins

No comments:

Post a Comment